Logout

Are you sure want to logout?

Yes

No

Full Name

Enter full name

Contact Number

Enter contact number

Enter valid contact number

Email Address

Enter email address

Enter valid email address

9 Jul 2022

9 Jul 2022

PayPal is an American multinational digital financial service company, which was both simplistic and brilliant. It operates as a payment processor, and also allows digital transactions without entering the credit card information on every visiting website. One needs to link the credit card and bank account to PayPal, then can contribute to a secure money pool.

One can shop here and also send money to other PayPal users. It has brought a strong purchase protection program for buyers and follows the Payment Card Industry Data Security Standard (PCI DSS). The platform is easy to use and is associated with security features. It protects the buyers from fraudulent activities, and also provides an option of receiving a refund when something goes wrong. One can send and receive money on the platform.

Our mission is to democratize financial services to ensure that everyone, regardless of background or economic standing, has access to affordable, convenient, and secure products and services to take control of their financial lives.

We believe access to affordable and convenient financial services should be a right for all rather than a privilege for the few. To achieve this, we are aligned across the company around one central vision: to make the movement and management of money as simple, secure, and affordable as possible.

PayPal was founded by Ken Howery, Luke Nosek, Max Levchin, Peter Thiel, Yu Pan, and Russell Simmons in December 1998.

Max Levchin and the founders thought to bring a revolution in internet payments.

It was established initially established as Confinity. It is used to provide security software for mobile devices. These Co-founders were designing and testing a digital transactions system in early 2000, and focused on establishing software security for individual clients, which caught the attention of Elon Musk, the creator of X.com, an online banking company. Later, in March 2000, Confinity joined hands with X.com which is an online banking company owned by Elon Musk. He decided that X.com would terminate its other internet banking services and mainly focus on this platform. Elon Musk was replaced by Peter Thiel as CEO of X.com. It was renamed as PayPal in 2001. The company grew rapidly on the path of progress.

It includes two types of accounts - Personal and Business. While opening the account, one needs to choose one option.

It is the most commonly used account by the people, which is convenient to use. The people send and receive cash from this account, and also make online purchases. One can have access to the history that shows the purchases made. Here the people can link with the new bank accounts and also add credit cards to the account.

One can request cash by signing in to their account. They can select the option Request Money for requesting money from others.

They need to enter the email address of the person to whom they want to ask for their cash. The app further needs to add the value of the request, a note, and, and also another email address, if asked. After clicking the option Request Now, the people need to wait for the funds to be sent. One can request payments in three ways.

1. Enter the name, email address, or mobile number of the person whom to ask for the cash. The further step is to enter the amount, add a message, review the amount, and click Request Now.

2. One can also Share the Link using social networks and email, which creates a clickable link that the recipient can use to send you money through the platform.

3. Split a Bill is ideal for paying at a restaurant. One can just input the value of the bill, add the email addresses of the group, and request the money.

It provides an opportunity for businesses to receive PayPal payments online. If the people do not have PayPal accounts, then too it allows the businesses to accept the payments. It also allows businesses and professionals to send invoices to clients and securely receive payments.

The platform is available with several options for sending and receiving money for business owners.

One can create an invoice with the PayPal account, which is associated with some options - a standard, one-off invoice, a recurring invoice, and an estimate. These include invoice numbers, addresses, and other options as well.

One can select the subscription product option, add their details, and further select a pricing model and a periodic fee, and avail the benefit of features of receiving regular payments.

The platform also offers an option for business accounts to receive payments using a virtual terminal system. With the help of this feature, one can process debit or credit card payments over the phone. Virtual terminal payments use card-not-present authorization and must be applied for before use.

QR codes is one of a great way to receive cash with convenience, which has attracted the interest of many people towards it.

1. It is convenient to use.

2. It provides a high level of security and prevents from fraudulent activities.

3. It refunds the money if there is a failure of payment.

4. It ensures the security of data and information of the users.

1. One can get free service while transferring and receiving money from friends and family. But if the transaction is associated with business, then one needs to pay the charged fees.

2. As a free bank transfer takes several days, so one needs to pay a charge of a 1% fee if they want instant access to their money.

3. PayPal becomes very aggressive with account freezes. If it decides to freeze the account of an individual, then it holds the money until the individual can prove that he has done nothing wrong.

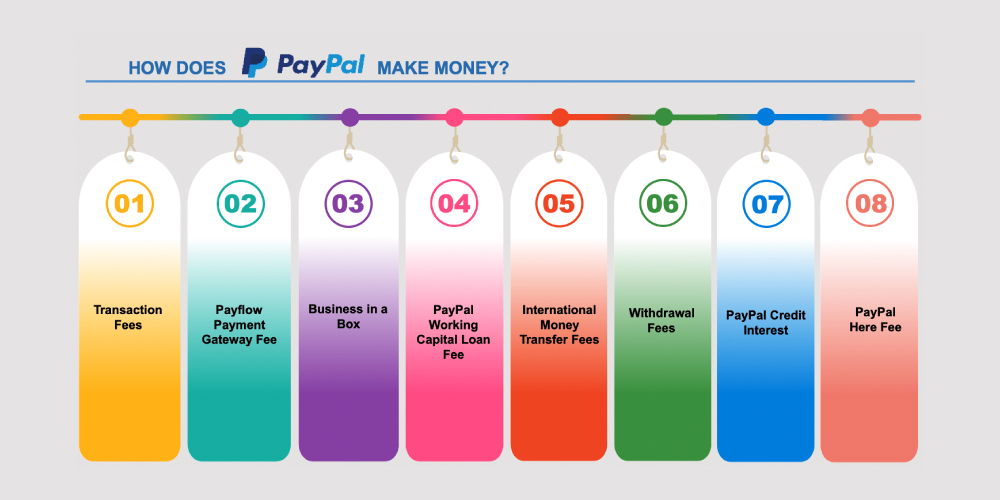

It charges fees with every transaction.

It charges fees while receiving international payments, which vary according to the currency.

PayPal charges fees everytime an individual withdraws money.

The money kept in PayPal is deposited in liquid investments, which provide interests in the form of revenue.

PayPal owns other companies, such as Braintree, Xoom, and Venmo, that add value and revenue sources to the company.

Payflow is the source for the merchant accounts can integrate into their websites. It charges fees for credit card payments.

It earns an affiliate commission with Xero and Woo Commerce.

It ensures that the merchants could never see the sensitive data and provides protection and security to the personal data. It is associated with several features such as end-to-end data encryption, optional two-factor account logins, and email confirmations for transactions that keep the accounts secure.

It is an online payment system that marks its importance in paying for things online and sending and receiving cash safely and securely.

When one links the bank account, credit card, or debit card with the PayPal account, then one can make purchases online with participating stores. It works between the bank and merchants and keeps the payment information secured and safe. One can send and receive money to family and friends with the help of this platform.

This is associated with free registration and offers free transactions without charging any fees or deducting any amount. It not even charge for international transactions. There is a 3% to 4% fee for the purchases made in foreign currency.

The app is associated with - Friends and Family tab, where one can click there to make personal transactions with family members and friends. Some of these transactions charge fees, on the basis of where the funds are drawn from and where it is sent.

It does not charge fees to transfer the account balance to a local account. One needs to wait for the funds while it gets transferred, but if a person needs immediate transfer, then it deducts a 1% fee.

[The images are being taken from the registered companies and belong to their respective owners only.]

Submit Design

Height and Width should be the same (e.g. 1000 x 1000)

Supported file formats : .JPG / .JEPG / .PNG