Logout

Are you sure want to logout?

Yes

No

Full Name

Enter full name

Contact Number

Enter contact number

Enter valid contact number

Email Address

Enter email address

Enter valid email address

1 Feb 2023

1 Feb 2023

Episodes 19 and 20 of Shark Tank India season 2 show investment given to the companies - Spice Story, Bullspree, Nitch, PORTL.

The show cultivates and promotes entrepreneurship in the country, providing a platform for entrepreneurs to showcase their ideas and receive feedback from experienced Sharks. It is beneficial for aspiring entrepreneurs and individuals interested in starting a business. It helps in boosting their brand recognition and helping them reach new customers.

This blog throws light on Spice Story who came with the vision to take the traditional taste to the world. The founders of Bullspree aim to simplify the stock market from small villages to bigger cities. The enthusiasm of the founder of Snitch convinced all the Sharks to make an investment in the business. The founders of PORTL astonished the Sharks with their innovative interactive fitness mirror, who aimed to make PORTL the third screen of every house after TV and mobile phone.

The founders asked the Sharks to imagine the movie Sholay without Basanti, the character Salim without Anarkali, or Shark Tank India without Sharks. It is the same as the Samosa without the Chutney and Idli without the Coconut Chutney. It does not give us a good feel and makes us feel enjoyable. They brought the taste from the lanes of India in the form of modern Sauce. They started their journey in 2019, and mark their presence on online marketplaces and quick commerce websites, and are also available offline in 1700 stores in 5 major cities in the country.

Their vision is to take the traditional taste to the world. Their annual sales for the FY 2019-20 were Rs. 1.5 Cr, Rs. 2.5 Cr in FY 2020-21, and Rs. 4.1 Cr in 2021-22. Their projection sales for FY 2022-23 is Rs. 9 Cr. They raised Rs. 1.7 Cr in the first round for a pre-money valuation of Rs. 10.6 Cr in the year 2021, and raised Rs. 3 Cr for a pre-money valuation of Rs. 23 Cr in the year 2022. The net sales in FY 2021-22 were Rs. 2.72 Cr. Their GMV (Gross Merchandise Value) is Rs. 57 Lakhs and their net revenue is Rs. 32 Lakhs. Their monthly EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) loss is around -12%. The price of their product is Rs. 150.

Rs. 70 Lakhs for 2% Equity, for Rs. 35 Crores valuation.

Rs. 70 Lakhs for 5% Equity, for Rs. 14 Crores valuation.

Namita Thapar.

The view they have shown is the story of every stock trader. The concepts of the stock market are complex, and if the person does not have the proper knowledge then he can face loss. They thought to simplify this complex issue with a fun game, hence they came up with the Bullspree.

Bullspree is a gaming application where people about the stock market. People can find many contests on the application that they can participate in and learn about the stock market. The people can log in to Bullspree and participate in the league contest. They can make stock profiles and watch live leaderboards on their stock profile. They also can see their rank as compared to the performance of the others. It does not allow the actual buying and selling of the stock, which is why the risk is low. They have onboarded 2 Lakh users in the last 6 months on the app. They aim to simplify the stock market from the small village to the bigger cities. It is an experiential learning platform from which people become well-versed and build confidence.

Bullspree can be downloaded from PlayStore or AppStore. It is associated with a list of various contests with different entry fees. They multiply the entry fees by 100 and give the Bullspree points, and the people need to make a list of stocks using these points that they think can perform well in that particular contest. The live leaderboard can be seen as per the stock price, and at the end of the contest the person whose portfolio is highest can get the rank accordingly. They charge a 20% commission in every contest. They raised the amount of Rs. 2 Cr with a post-money valuation of Rs. 12.5 Cr in September 2021, and Rs. 1 Cr with a post-money valuation of Rs. 26.5 Cr in February 2022. Their CAC (Customer Acquisition Cost) is Rs. 52, and the Average revenue per paid user in February 2022 was Rs. 21 and Rs. 322 in July 2022. Their monthly burn is Rs. 18 Lakhs.

Rs. 75 Lakhs for 1.5% Equity, for Rs. 50 Crores valuation.

Rs. 26 Lakhs for 1% Equity, and Rs. 49 Lakhs Debt, for Rs. 26 Crores valuation.

Rs. 75 Lakhs for 2.86% Equity, for Rs. 26.22 Crores valuation.

Aman Gupta & Peyush Bansal.

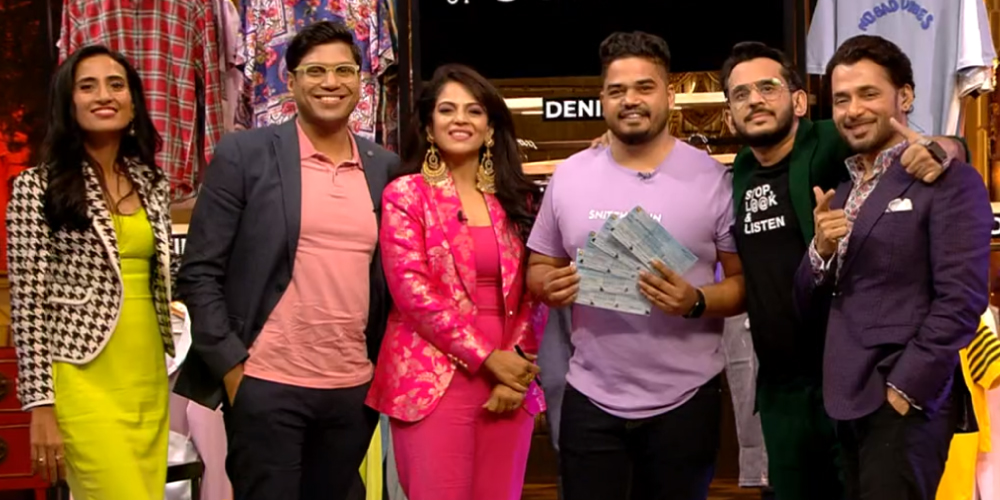

The founder conveyed that there is a problem that he is a boy and he does not have stylish, glamorous, colorful, and exciting clothes as girls wear. Snitch is a fast-growing, and fast fashion brand in India for men. Their website is available with shirts, T-shirts, Denim, and a lot more. They started the website in 2020, and they order 2,000+ orders on a daily basis. His vision is to make Snitch the biggest fashionable brand for men in India and then to capture the global market.

They currently have 50,000+ visitors on the website and 5 Lakhs app downloads. Their conversion rate is 2.5% - 2.8% and the average order value is Rs. 1,700. They earned Rs. 6 Cr from their own website, Rs. 1 Cr from marketplaces, and Rs. 2.3 Cr from offline retailers. The COGS (Cost of Goods Sold) was 52% and the gross margin was 48%. Their 24% goes to marketing, 10% goes to shipping, 9% to operating and 5% is their EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation). Their revenue for FY 2021-22 was Rs. 44 Cr and the projection sales for FY 2022-23 are around Rs. 90 Cr - 100 Cr.

Rs. 1.5 Crores for 0.5% Equity, for Rs. 300 Crores valuation.

Rs. 1.5 Crores for 1.5% Equity, for Rs. 100 Crores valuation.

All Sharks.

The founders conveyed that usually, people see their flaws. What if a mirror turns flaws into qualities? It is not imagination, but reality.

PORTL is a life-size interactive fitness mirror, which is a multifunctional home gym with a built-in personal trainer. It not only makes you do workout but also constantly monitors people with its technology, and gives real-time feedback and guidance. It provides personalized and relevant workouts for its users. It also gives access to a wide variety of workouts. Through their subscriptions and value-added services, people can avail of life classes, nutrition coaching, and mental wellness.

They have confirmed 5,000+ orders, and show its availability across their own website or experience centers. Their vision is to make PORTL should become the third screen of every house after TV and mobile phone. Its price is Rs. 1.25K. They raised Rs. 7.5 Cr with a post-money valuation of Rs. 30 Cr in June 2021. They have 5,500 units of confirmed orders, and their gross margin is 45% through customers, 30% through distributors, and 52% through the international market. Their projection annual burn is Rs. 3 Cr. Their monthly burn is Rs. 26 Lakhs, monthly sales are Rs. 10 Lakhs and monthly expenses are Rs. 36 Lakhs.

Rs. 1.5 Crores for 1% Equity, for Rs. 150 Crores.

Rs. 1.5 Crores for 5% Equity, for Rs. 30 Crores valuation.

Rs. 50 Lakhs for 1% Equity, and Rs. 1 Crore Debt at 12% Interest, for Rs. 50 Crores valuation.

Rs. 1 Crore for 2% Equity, and Rs. 50 Lakhs Debt, for Rs. 50 Crores valuation.

Rs. 1 Crore for 2.5% Equity, and Rs. 50 Lakhs Debt, for Rs. 40 Crores valuation.

Rs. 1.5 Crores for 2.5% Equity, and Rs. 1 Crore Debt at 12% Interest, for Rs. 60 Crores valuation.

Rs. 1.5 Crores for 2.5% Equity, for Rs. 60 Crores valuation.

Namita Thapar, Peyush Bansal & Aman Gupta.

[The images are being taken from the registered companies and belong to their respective owners only.]

Submit Design

Height and Width should be the same (e.g. 1000 x 1000)

Supported file formats : .JPG / .JEPG / .PNG